Introduction

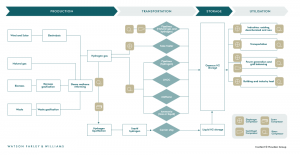

Earlier this year, the UAE held the Connecting Green Hydrogen MENA 2022 conference which members of the WFW Dubai structured finance and energy & projects teams attended. Green hydrogen will be a key part of the world’s transition to net zero carbon emissions, and its utilisation (through various forms) will be an important feature of the next 30 years as use of green hydrogen-related energy in the global economy increases. We believe this will be particularly prevalent in high polluting industries where electrification is either not possible or less feasible.