Watson Farley & Williams (“WFW”) has advised IDeA CCRII Fund (“IDeA CCRII”), managed by DeA Capital Alternative Funds SGR S.p.A. (“DeA Capital”), on the sale of five cargo vessels to Navigazione Montanari Group (“Navigazione Montatari”).

The five vessels, “Aethalia”, “Korsaro”, “Neverland Dream”, “Miss Marina” and “Miss Benedetta” were acquired by Euromont Shipping Company S.p.A. (“Euromont”), which is part of Navigazione Montanari, for a total purchase price of US$85m partly financed through a SACE guarantee loan structured by illimity Bank (“illimity”) and partly syndicated with Solution Bank.

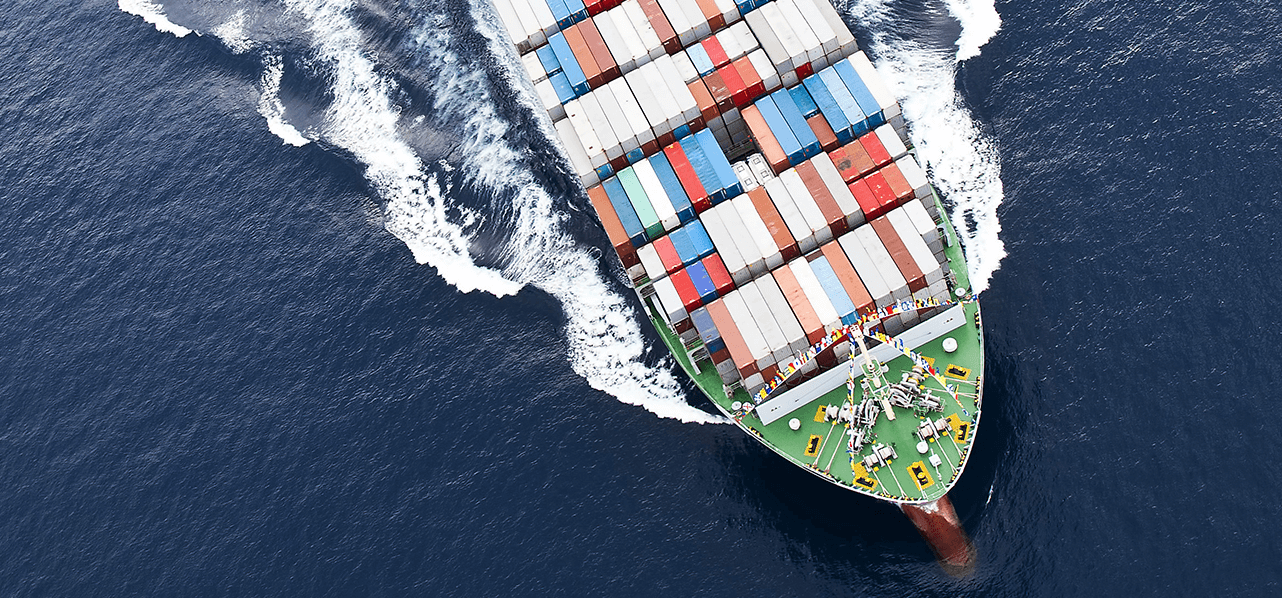

All five vessels will fly the Italian flag and operate in the oil, product, chemical tanker and bulker segments.

A multi-disciplinary WFW Italy team advised DeA Capital on all aspects of the transaction relating to the drafting and negotiation of the contract documentation, including those concerning the sale of the individual vessels. The team was led by Maritime Partner Furio Samela, assisted by Senior Associate Antonella Barbarito and Associates Beatrice D’Amato, Sergio Napolitano and Noemi D’Alessio. Partner Carlo Cosmelli advised on corporate law matters, supported by Senior Associate Roberta Sturiale.

Furio commented: “We are very pleased to have helped close this complex transaction which allows IDeA CCRII to establish an industrial partnership with Navigazione Montanari and for the latter to consolidate its position as one of the major players in the Italian maritime sector. This instruction highlights WFW Italy’s expertise across all core service lines and cements the firm’s reputation for excellence in the maritime space”.

DLA Piper acted for Euromont and Chiomenti for illimity and Solution Bank.