In this piece we will discuss:

- What are electronic and digital signatures?

- Objectives of the Digital Signature Methodology

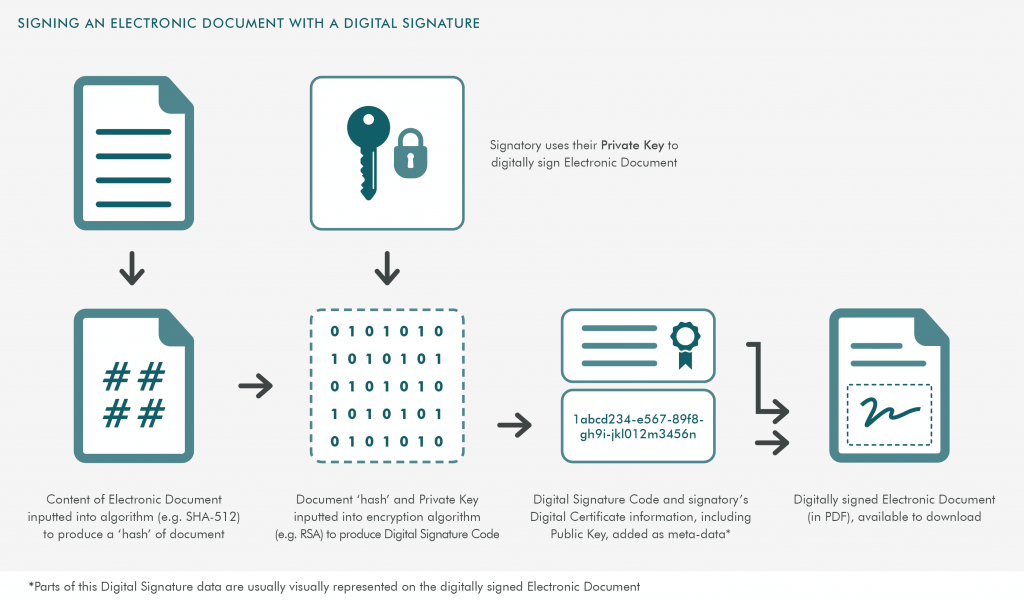

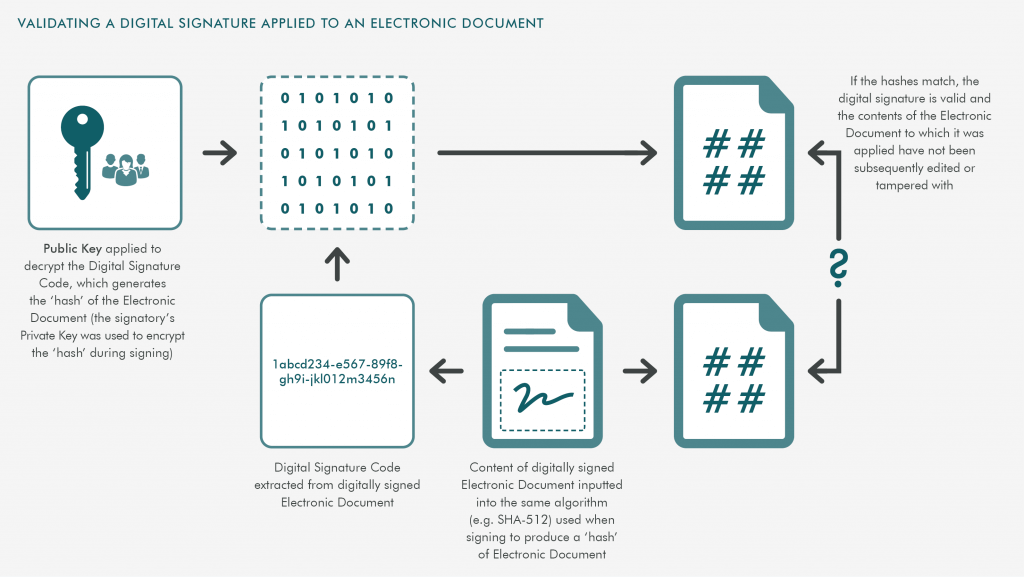

- Signing an electronic document with a digital signature

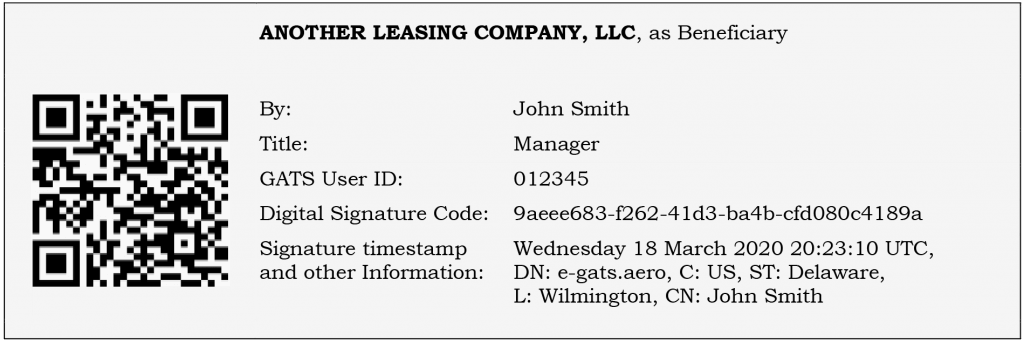

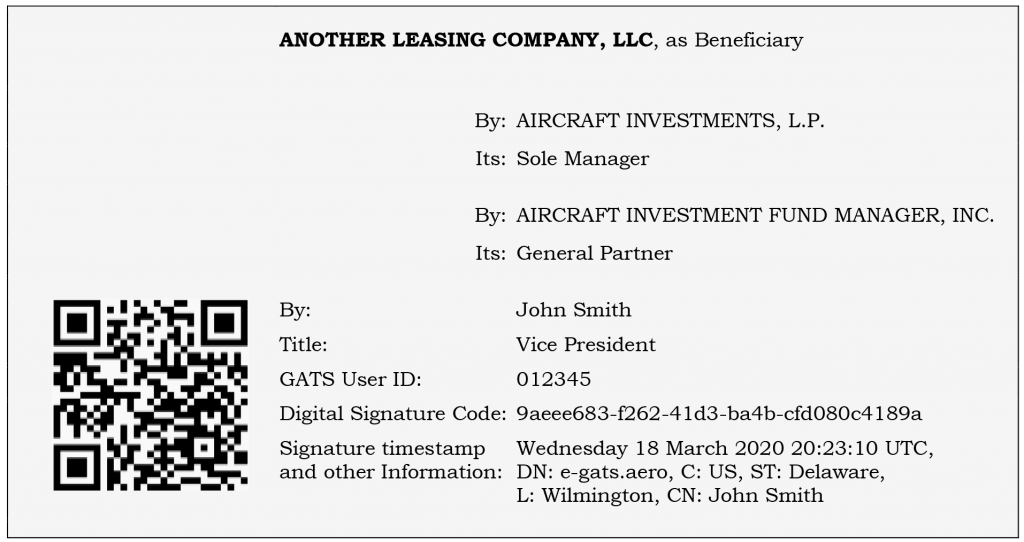

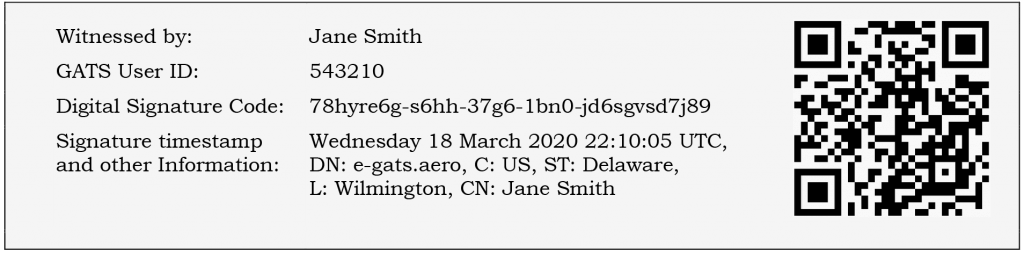

- Visual representation of digital signatures

- The GATS online platform: customisation; addressing logistical and practical challenges