Watson Farley & Williams (“WFW”) advised Trinity Investment D.A.C. (“Trinity”) and Deutsche Bank AG, London branch (“Deutsche Bank”) as secured creditors/participants in the restructuring of Italian shipping company Gestioni Armatoriali (“Gestioni”) under Article 182-bis of the Italian bankruptcy law and the establishment of a new ownership and management structure to operate and employ ten vessels previously in the Gestioni fleet.

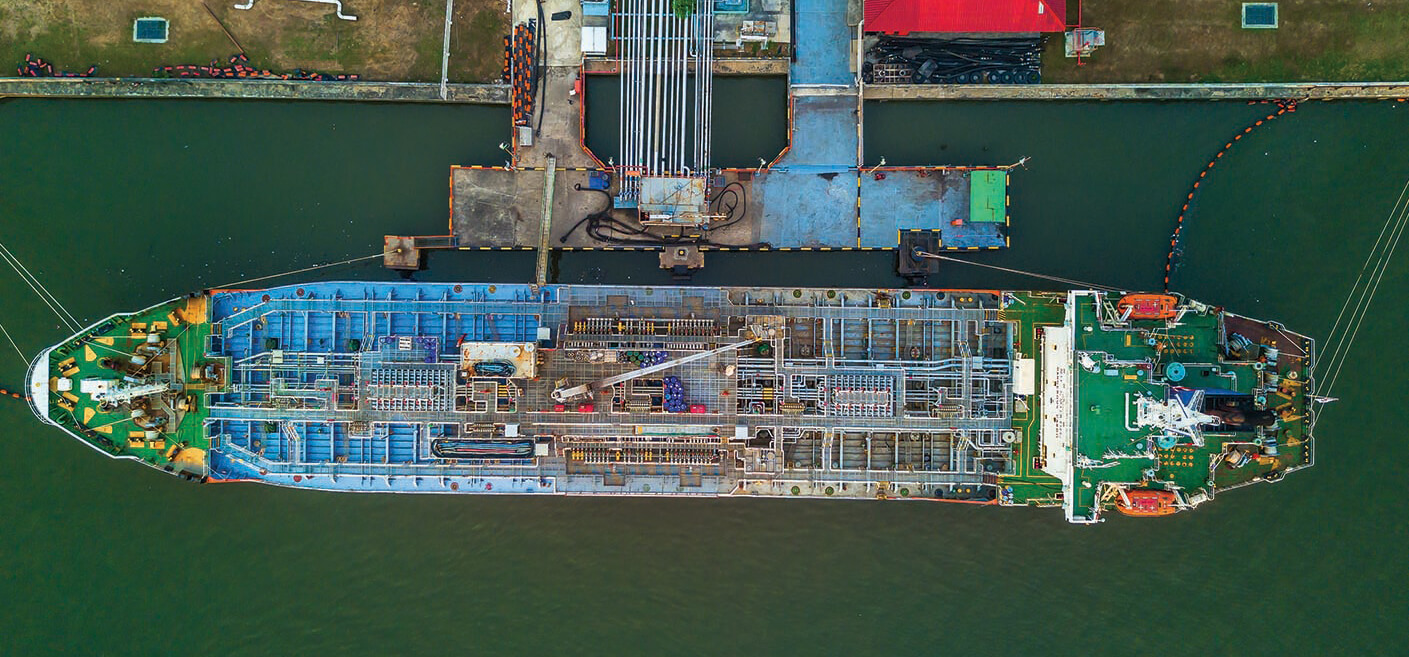

The restructuring involved a reconfiguration of debt and mortgaged vessels between Gestioni’s secured creditors and the transfer of ten bulk carrier and tanker vessels to a new Malta-based ownership structure, which assumed part of Gestioni’s debt, and the change of the vessels from Italian to Malta flags.